2025 TAX INCENTIVES FOR STONE FABRICATORS WITH SECTION 179

How Section 179 Helps You Invest in Equipment

Maximize

Deductions

Leverage Section 179 to reduce your tax liability and reinvest in your business.

Boost

Productivity

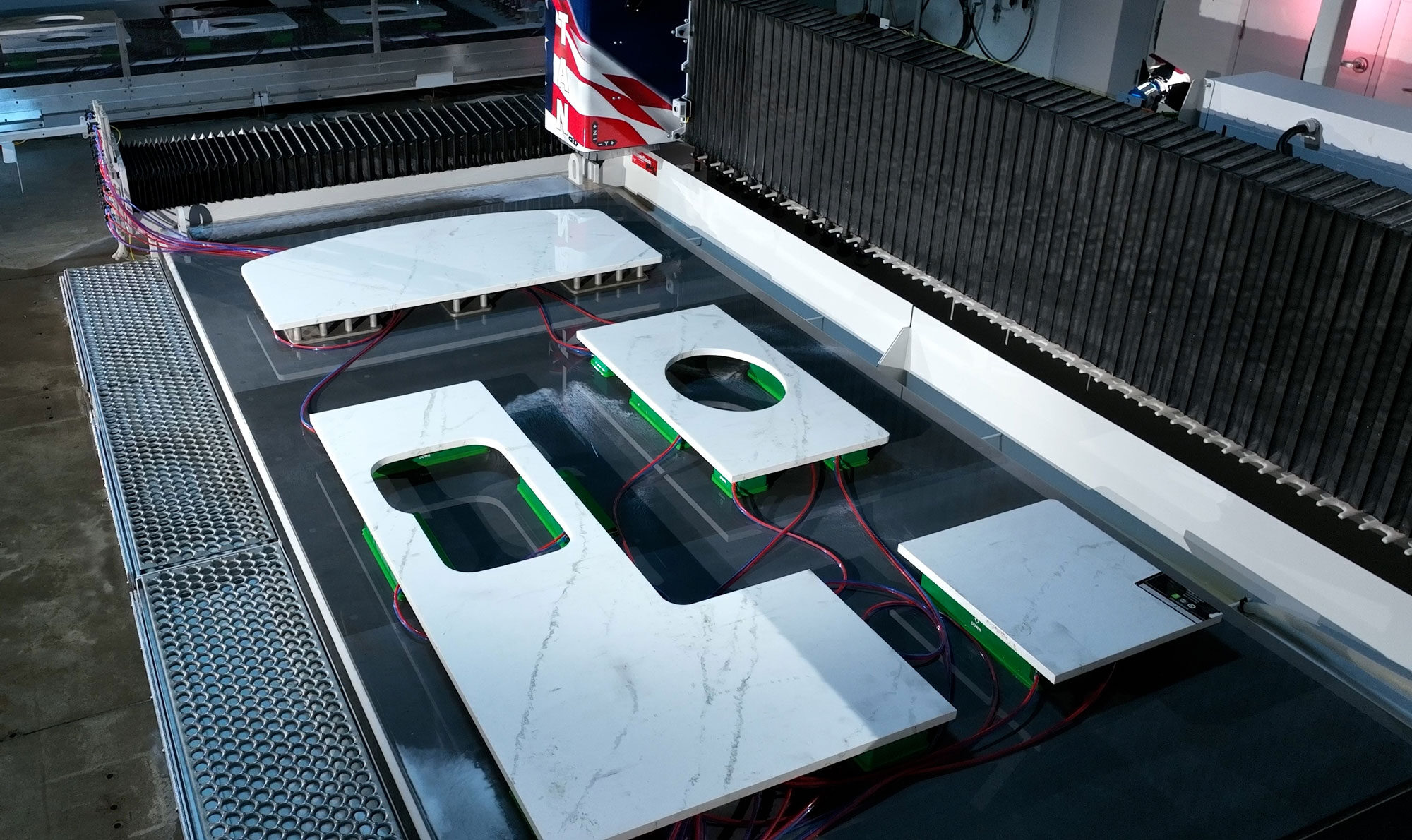

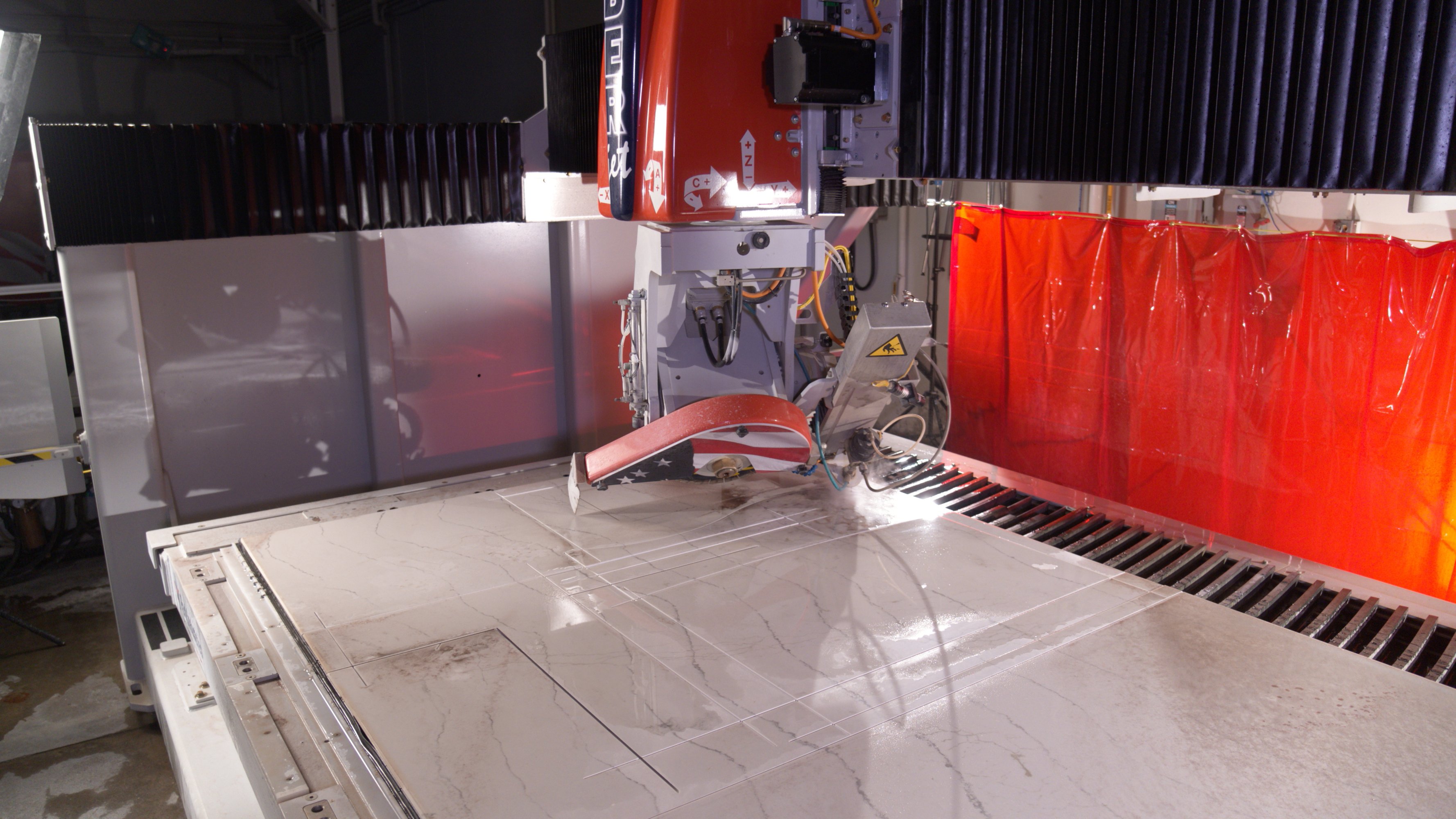

Invest in CNC machinery from Park Industries® to enhance your operations.

Secure Your

Savings

Secure your 2025 tax benefits before the December 31st deadline.

What Is Section 179?

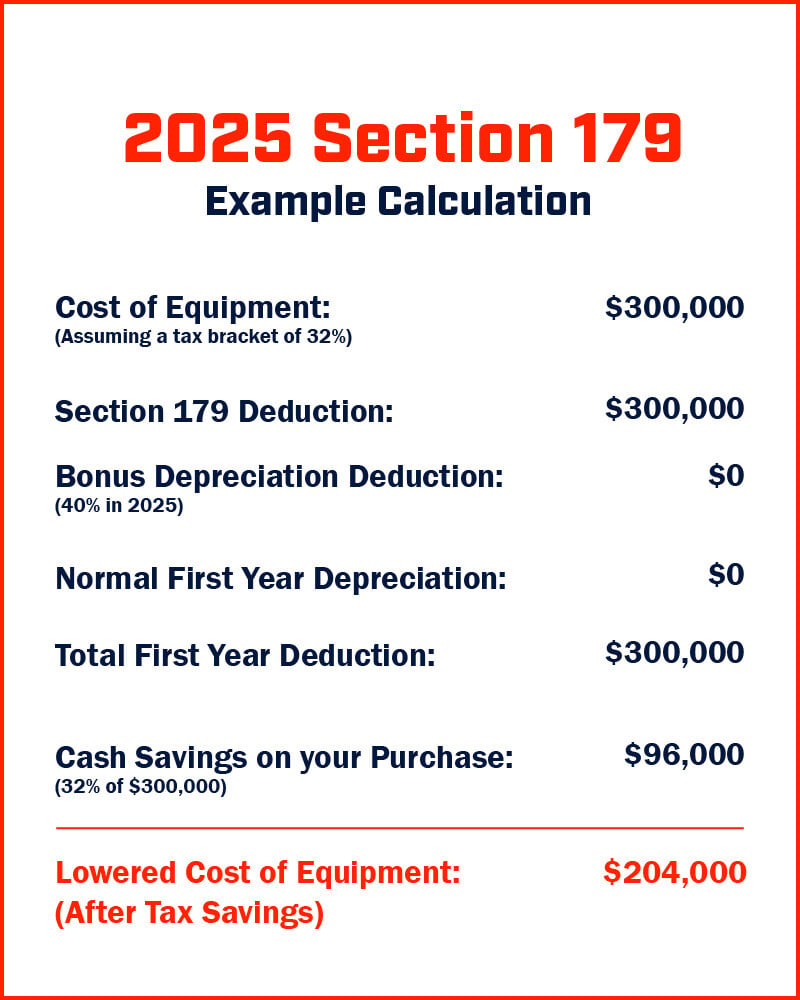

Section 179 is a powerful tax incentive designed to encourage businesses, such as stone fabricators, to invest in new equipment. By allowing businesses to deduct the full purchase price of qualifying equipment from their gross income, Section 179 helps you grow your business while significantly reducing your tax liability.

Maximum deduction for 2025: $1,250,000

How Section 179 Works

(In Simple Terms)

Imagine you purchase a new machine for $75,000. By leveraging the Section 179 deduction, the effective cost of this equipment plummets to just $48,750 after tax deductions. That’s a substantial savings of $26,250.

Wouldn’t you appreciate an additional $25,000+ to reinvest in your business this year? The higher the machine investment, the greater the savings.

Why Should Stone Fabricators Take Advantage of Section 179 in 2025?

If you’re considering new equipment for your business, 2025 is the perfect year to make that investment. This year offers exceptionally generous tax deductions, including enhanced bonus depreciation. But act fast—these benefits are scheduled to be reduced in 2025.

Bonus Depreciation Reductions Coming

2025: 40%

2026: 20%

How Much Time is Left to Take Advantage of Section 179 for 2025?

If you’ve already purchased equipment this year, you’re in great shape.

The Section 179 tax-saving opportunities are available through the end of 2025, but the equipment must be installed in your facility by

December 31, 2025.

I take advantage of these tax incentives annually. Rather than paying taxes, I purchase equipment that reduces my payroll hours AND I get to take a large first year depreciation, sometimes the entire purchase price of the machine — the tax savings are huge!

Partner with Park Industries on Section 179

Want to understand Section 179 better or start talking about how you add new machinery now to make yourself more profitable in 2026? Park Industries® would be happy to visit with you about Section 179 or fly you to Park Industries to see a machine demo (at our expense) - just let us know below!